In January 2022, Apple was marked by a serious achievement – it became the first in the history of the global stock market, who managed to overcome the milestone of $3 trillion in market value, and the segment from $2 trillion to $3 trillion was overcome by the iPhone manufacturer in less than 1.5 years. And now, after half a year, Apple has lost almost a trillion dollars of market value, and its capitalization is rapidly reaching the $2 trillion mark , and, given the current situation, the stock will probably continue to fall.

A fall in Apple’s market value below $2 trillion in the near future looks very likely and it is still difficult to say when the company’s stock price will return to an upward trajectory. Last quarter was Apple’s best start to the year ever , with record iPhone and Mac sales generating nearly $100 billion in revenue. At the same time, the forecast for this quarter is disappointing – sales are expected to decline by $4-$8 billion amid logistics problems due to COVID-19.

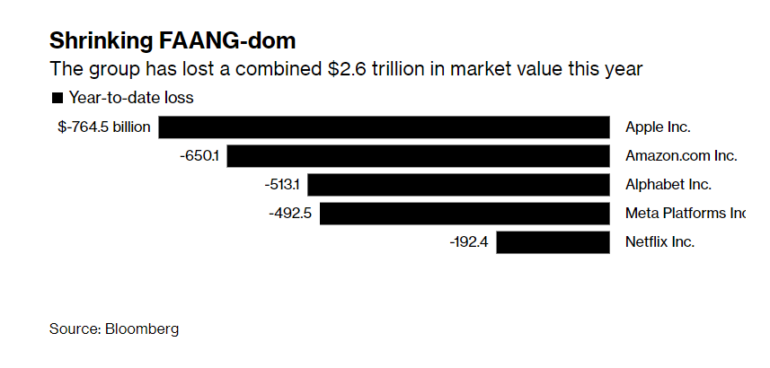

The situation is no better for other technology companies – the cumulative losses of the “big five” IT companies FAANG (an abbreviation of Facebook, Amazon, Apple, Netflix, Google) since the beginning of the year have already reached $ 2.6 trillion (we are talking about an indicator of market value).

As you know, the US stock market is rapidly falling down along with the cryptocurrency market. And if the capitalization of the cryptocurrency market has decreased from $3 trillion to $1 trillion since the end of 2021, then the losses of US households as a result of falling stocks amount to about $8 trillion, according to Goldman Sachs. The reasons in both cases are the same – for the most part, these are the consequences of inflation in the United States, as well as the approach of a global recession and a food crisis.

And short-term forecasts do not particularly give optimism. On June 15, the US Federal Reserve once again raised the base rate to a record high – for the first time since 1994, it was increased immediately by 0.75%, to 1.5-1.75% per annum. The Fed also said it would consider further rate hikes by 50 basis points in 2022.