Hey.

We continue the series of articles in which we consider the results of 2020, the main events on the market. In this article, we will focus on smartphone manufacturers, the main milestones that determined the situation. Since the smartphone market is in the context of the entire electronics market and what is happening in the world, it will be useful to read an article that describes macroeconomic events.

And we will start by assessing what the 2020 market was like and why many negative predictions did not come true, or rather, came true, but not for all manufacturers.

Content

- Fog of war and pessimistic forecasts of the beginning of the year

- C-Brands Endangered – Size Matters

- Push-button phones – market decline, fast transition to smartphones

- Short conclusions

Fog of war and pessimistic forecasts of the beginning of the year

At the beginning of 2020, bad news emerged one after another, the epidemic was only gaining momentum, the press highlighted problems every day, and China’s actions caused amazement – was it a joke, cities and regions with tens of millions of inhabitants were quarantined in the country. Including technological hubs, on which the production of components for electronic devices, their assembly, as well as logistics depended. China was the first to rise, production stopped for several months. The manufacturers who were the first to realize the scale of the impending events bought components for blocks in advance, bought out everything they could reach – batteries, power management chips, resistors and capacitors. Suppliers rejoiced at the money that had fallen from the sky, but realized that there was a period ahead when there would be no supplies at all, as the factories would stop.

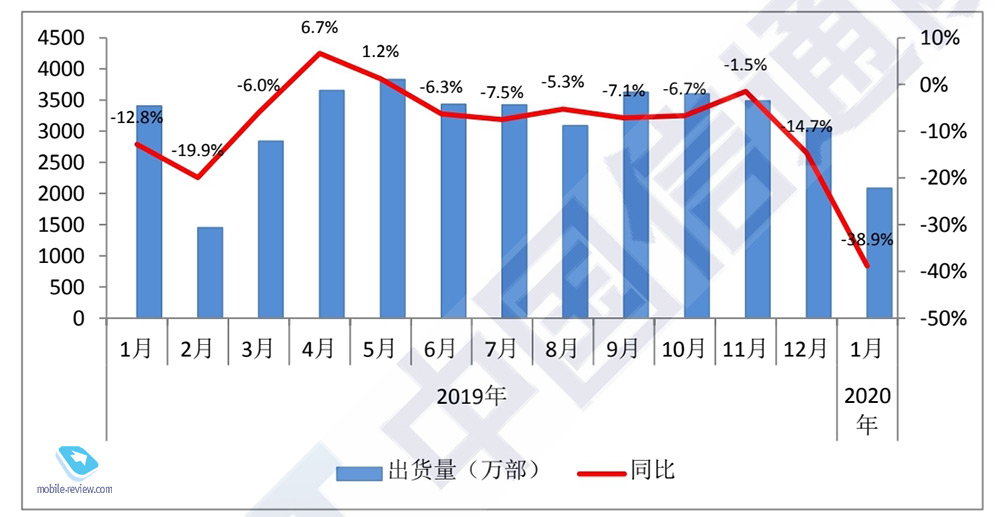

Everyone carefully watched how the Chinese market would behave, the results of January sales turned out to be depressing, the fall was almost 40% year on year.

The main reason for the drop in sales was quarantine, or rather, closed stores. Customers disappeared from the streets of cities, shops closed their doors. And even if you could produce something, had factories in other countries, it did not matter – there were no sales due to the lack of people and closed retail chains.

In the first quarter, manufacturers and retailers around the world were calculating options for a market decline, one forecast looked worse than the other, competed in who and how many tens of percent will remove from the original plans. The decline in sales year-on-year by 20-25% was considered optimistic, and an estimate of 30-35% was considered weighted. No one expected such a large-scale crisis, a black swan appeared out of nowhere.

Looking back, we can say that everyone, without exception, was mistaken. The crisis was unprecedented in scale and impact on all markets, but the monetary authorities of most countries turned on printing presses. Therefore, the closed stores, the lack of sales in certain periods were mitigated by the presence of money from the population, which they spent on electronics, primarily smartphones, since this is a favorite toy of several generations, a device without which it is impossible to imagine your life.

The cancellation of industry shows, the spring announcements of models that were planned to start selling in March 2020, were postponed to a later date. Many companies simply did not have time to start producing them, and under quarantine conditions they did not have such an opportunity in principle. The Chinese government made an exception for Huawei / Honor, the company’s factories continued to operate, as did key component suppliers for them. It can be said that this supported Huawei’s sales in the first half of the year, when other players could not do anything. Samsung also did not have any effect of quarantine on production, since the main factories are located outside China, the company has consistently taken them to Vietnam, and several factories are located in South Korea. The production was stopped for several days due to the virus, the rest of the time the lines worked, the goods were in abundance. But the most important thing is that the R&D centers continued to work all this time, did not leave for remote work. Ultimately, this allowed the company to keep up with the release schedule of models and even accelerate the development of new lines in order to make a breakthrough in 2021, to change the plan for the release of new series. So, the Galaxy S21 family does not come out in March, as usual, but already in January. The reason for this was the delay in launching the iPhone 12 to the market, Apple could not level the closure of China, the factories standing in the first quarter of production. Considering that at Apple part of the development is Foxconn, and the company’s engineers could not get to the factories, the result is clear: the release date of the 12th series was delayed by 1.5-2 months.

The key event for the market in the second half of 2020 was the sanctions against Huawei by the US government. They were consistently tightened, chipset and memory manufacturers could not supply components for smartphones without a separate license. Therefore, Huawei was preparing to stop deliveries and purchased all the components that they could reach – chipsets, screens, memory. Price did not play a big role, suppliers worked in three shifts, 24 by 7. Given the size of Huawei and the volume of purchases for two to three quarters of production, there was an anomaly that could not be compensated in any way. Component prices went up for most of the players, unexpectedly, suppliers of every little thing began to feel like kings.

Scarcity is the word that can be used to describe 2020 for the electronics market and for almost all players. On the one hand, negative forecasts were made at the beginning of the year, and component suppliers adjusted to them. Then Huawei’s purchases played a role, sweeping components out of the market and creating an additional deficit. At the planning and production stage, problems arose, and they affected all companies that do not have vertically oriented production, that is, they do not have their own key components. As an example, we can cite Apple, the company did not buy in advance power microcircuits for the 12th iPhones, as a result, it was faced with the fact that it could not purchase them, as it did in previous years. The price that Apple was willing to pay for such a microcircuit turned out to be several times lower than the market average. While the bidding stage, in which Apple hoped to succeed, went on, the chips went to other manufacturers at announced prices. The damage to the new 12th iPhones has been enormous, as they are produced in less quantities than the market needs. And this is not some kind of calculation, but planning errors, misunderstanding of the deficit of components that has arisen on the market.

Improper planning was superimposed on the growth of demand in the second half of the year, when the retail market revived, people in all countries began to buy electronics, including smartphones. There was a serious shortage in channels, there was a sufficient supply from Samsung, the company did not stop shipments for a year.

It is extremely rare in the market that there are situations when a large player unexpectedly loses its market share, but this happened with Huawei. Orientation to the Chinese market, on which the stake was made, led to the squeezing of other Chinese companies into foreign markets. It is Huawei that begins to dominate inside China, but at the same time loses markets outside of it. Look at third quarter sales in Western Europe.

The drop in Huawei’s sales in absolute numbers is staggering, minus 3.7 million smartphones in just one quarter. In other countries the picture is similar, the company is losing the market. At the end of the year, the Honor brand is sold to get it out of sanctions, in 2021 it is planned to return to all markets, an attempt to regain a share.

The beneficiary from the fall of Huawei is not Samsung or Apple, but brands that are perceived in a similar way, primarily Xiaomi, the company’s sales are growing by leaps and bounds. In Russia, the Xiaomi brand doubles its market share, by the fourth quarter of 2020 it is already 20% of the market and the third place in unit sales. There is a shortage on Xiaomi, running models cannot be purchased, other players, for example, OPPO (as an option, Realme) also benefit from this.

For several years, Xiaomi’s pricing policy does not imply price dumping, often it is not even the most optimal price / quality ratio. But in the eyes of buyers in many countries around the world, these are the “best” devices for the price. Few people delve into the analysis of the proposal, the assessment is based on external features and cost. Xiaomi ultimately skyrockets in sales, but growth is hampered by a lack of components and manufacturing capacity. We can safely say that 2020 is the year of Xiaomi’s take-off, the heyday of the company.

Considering that in 2021, both Huawei and the spun-off Honor will try to regain their sales in foreign markets, one can expect intense competition, aggressive cost reduction on store shelves. Both companies have enough financial resources for this, so they will aggressively eat off market share, primarily from Xiaomi. It is impossible to predict where this will lead, since there are too many unknowns in the equation. An abnormal rise may be followed by a slight drop, but if the company starts offering its devices at lower prices, it will be on a par with competitors. And here the question is, to what extent Xiaomi is ready to give part of its profits to the price war. The company will lose the battle for attrition, there are no resources behind it comparable to Huawei or even Honor in a new capacity. Therefore, we will clearly see some intermediate options when the company will try to achieve its goals through proper marketing and PR. These are the strengths for Xiaomi at the moment, and perhaps they will become even stronger. People’s love for the brand has not waned, in 2020 a new army of neophytes joined the brand.

The 2020 market turned out to be unexpectedly good for smartphone manufacturers, the market decline in many countries was not as severe as expected, almost all companies have a deficit and a lack of supply. Ideal situation? Better than it could have been, but it is definitely impossible to call the market ideal.

C-Brands Endangered – Size Matters

The year was also good for retailers and manufacturers because the shortage leads to sales of old models that are not optimal in terms of cost and are stuck on shelves and warehouses. In 2020, the market gradually digested the old leftovers, went through a cleansing process. Those models that seemed illiquid at the end of 2019 suddenly began to sell better and better until they disappeared altogether. For many manufacturers, this was an unexpected bonus in a difficult year.

But the size of C-brands, as a rule, does not allow purchasing large volumes of components, and they were in short supply. A wave of production refusals swept through the market, orders already placed were massively canceled, starting in May this became the new norm. Approved models, money spent on localization, purchase of individual components – all this went to hell. The old model of working with Chinese factories has failed. The activity of Huawei, which bought almost all processors from MediaTek, led to the fact that the finished models could not be put into production, there were no processors. The scarcity hit the C-brands the most.

The strategy of survival for them was orientation to Spreadtrum, happiness came to this manufacturer, its chipsets suddenly became popular, since nothing else could be obtained. But the problem was that it was necessary to take the finished model on MediaTek and rework it on Spreadtrum, this is additional time and money. Not all companies decided on this, many simply recorded losses, and a series of bankruptcies occurred, which swept across all countries.

Those C-brands that had supporting businesses, read, money, were able to get out at least for a while, continue to create a line of devices. But for them, the cost price has also increased, as a result, the price on store shelves. Companies without discernible resources have switched to small-scale production, with small Chinese companies creating the goods. They get the components by hook or by crook, often it is rejection or components taken from “dead” devices. It is impossible to build on this mass production.

The presence of Chinese factories that produce inexpensive budget devices has always been an annoying factor for large companies such as Samsung. For Samsung, the production of budget models could not be profitable, they cannibalized sales in other price segments, which reduced profits. Against the background of Chinese smartphones, we had to maintain a low profit margin, or rather, there was no profit margin at all, since the production costs of Samsung and any Chinese factory differ significantly, if not by an order of magnitude. By default, it was impossible to achieve the same efficiency.

In 2020, Samsung will partially solve this problem for itself, as the younger models of the A-series, as well as the M-series, go to Chinese ODM manufacturers. This reduces their cost and allows them to directly compete with the very same Chinese. Galaxy A01 becomes the key model in the budget segment, this model is the starting point for any player in this segment.

Samsung’s huge marketing machine is starting to knock out competitors in select markets by offering the Galaxy A01 in various promotions at discounted prices. This is a need for a moment to not just destroy the C-brands that live by placing orders in Chinese factories. This is a blow to the factories themselves, which will lose customers and will not be able to survive in 2021. The moment was chosen well, Samsung is also helping BBK Corporation (OPPO, Vivo, Realme) as much as possible, as it takes away some of the sales from Xiaomi, takes away the sales of Huawei. The company knows how to play in the long run, building a strategy for a decade. This time, the cycle affects not only the displays, as it happened before, but also other components. Samsung’s task is to bring all manufacturers to a common denominator, make production equal in cost and remove relatively small factories from the market. The crisis is the perfect time for that, and the strategy looks to be working.

In 2020, Samsung does not consider market share as a priority; competitors are being cleaned out, territory is being cleaned up. Having prepared the ground, the company wants to increase its sales, but even here the strategy is very moderate. Why sell a lot of your smartphones, if the sales of components can bring much more, the main thing here is to correctly manage the shares of your competitors who buy your technologies. Extremely cautious steps in the market, the company does not meet any resistance, remains number one in sales, the threat from Huawei has disappeared, and it is unlikely that something like this will happen again in the next couple of years.

Push-button phones – market decline, fast transition to smartphones

The push-button phone market is almost never remembered as if it did not exist. Nevertheless, these are tens of millions of devices that are chosen not only because of the cost, but out of conviction.

To illustrate the importance of push-button phones for the market, I will cite IDC data for the third quarter of 2020 in the Russian market. 9.4 million smartphones were delivered to the country, and 2 million were imported. A similar proportion is observed in all countries of the world, but the time of the “button” is gradually passing away.

In Russia, push-button telephones are popular, on the networks of operators there are slightly less than half of them (still!). But many people simply do not know about this, they believe that the segment is dead, although this is far from the case. At the beginning of 2020, a massive rejection of push-button phones by the elderly begins in Russia. They were accustomed and comfortable with a “button”, but quarantine forces them to receive QR codes to go somewhere, and it is almost impossible to do this with a push-button telephone.

But the biggest blow to the button market is inflicted by labor migrants who fill construction projects in the country in calm times, work as janitors, couriers and more. Push-button phones are popular with them, smartphones are issued at work, for example, wipers record the results of work on the phone and report this to their superiors. Now you can check not only the quality of work without leaving the office, but also watch the time when it is done, and without any complex IT systems.

A push-button telephone is a personal item, a smartphone is given out at work. But there is almost no work, or they pay little for it, so labor migrants sit out turbulent times at home, there is no influx of new people. This is felt not only in the sales of push-button devices, but operators also do not see SIM-cards, which they used to rake in the thousands. Calls to the Central Asian states are unexpectedly reduced, the direction is not as popular as it used to be.

Short conclusions

In this article, we touched on only the main events, drew the canvas in which the smartphone and phone market lived in 2020. In a separate article, it will be necessary to consider the technologies that we received, and how they differ from what has already been. You also need to consider the key models and their impact on the market, but it is impossible to do this within the framework of one material. Of course, a forecast will be given of how the market will change in 2021, this will also, apparently, be a separate text.

In the meantime, I want to describe my feelings from 2020 in the smartphone market. The first thing that comes to mind is scarcity. All current models are lacking, there are no components. On the other hand, the buyer is not ready to overpay for the goods, which leads to a paradoxical situation: there is a shortage, but prices do not rise, but on the contrary, they fall during isolation, since most stores are closed.

Only the prices of flagships are being increased, since this is inevitable given the amount of technology that is invested in them.

The year is difficult for all players. While some are preparing to reformat the market for themselves in the coming years, others are trying to survive with varying degrees of success. The market is chaotic, as the old rules hardly work, and decisions must be made as quickly as possible and be able to change the strategy on the fly. Not all companies succeed in this, as can be seen from the “Others” segment, it suffers more than others. But in the end, the year was not as bad as it seemed at the beginning of the year.

Back to content >>>

Related Links

Share:

we are in social networks:

Anything to add ?! Write … eldar@mobile-review.com