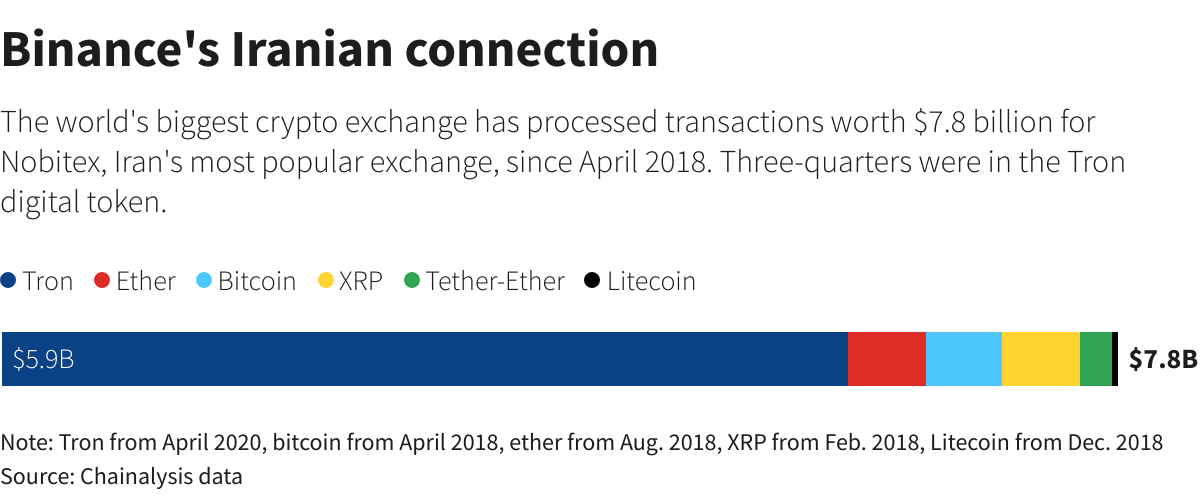

Since 2018, Binance has processed $7.8 billion worth of Iranian transactions despite US sanctions aimed at shutting Iran off from the global financial system. Almost all funds flowed between Binance and Iran’s largest crypto exchange Nobitex, the latter publishing instructions on its website on how to circumvent sanctions.

Three-quarters of the Iranian funds that passed through Binance were in a relatively obscure cryptocurrency called Tron, which gives users the ability to hide their identity. In a blog post last year, Nobitex encouraged clients to use Tron, a mid-tier token, to trade anonymously without “threat to assets due to sanctions.”

The scale and duration of Iranian crypto flows came to light as the US Department of Justice is investigating money laundering by Binance (dominating the $1 trillion crypto industry with over 120 million users). Lawyers and trade sanctions experts said the company’s transactions violated U.S. bans on doing business with Iran.

In July, Reuters revealed that Binance continues to serve customers in Iran. On the day the article was published, the crypto exchange said in a blog post that it was complying with the rules of international sanctions against Iran and blocking access to the platform to anyone who is there. The billionaire founder of the exchange, Changpeng Zhao, tweeted:

“Binance banned Iranian users after the sanctions, 7 found a workaround, they got banned later anyway.”

Binance did not respond to questions about the new transactions discovered by Reuters. In a statement, spokesman Patrick Hillmann said:

“Binance.com is not a US company. However, we have taken proactive steps to limit our impact on the Iranian market by working with industry partners and internal tools.”

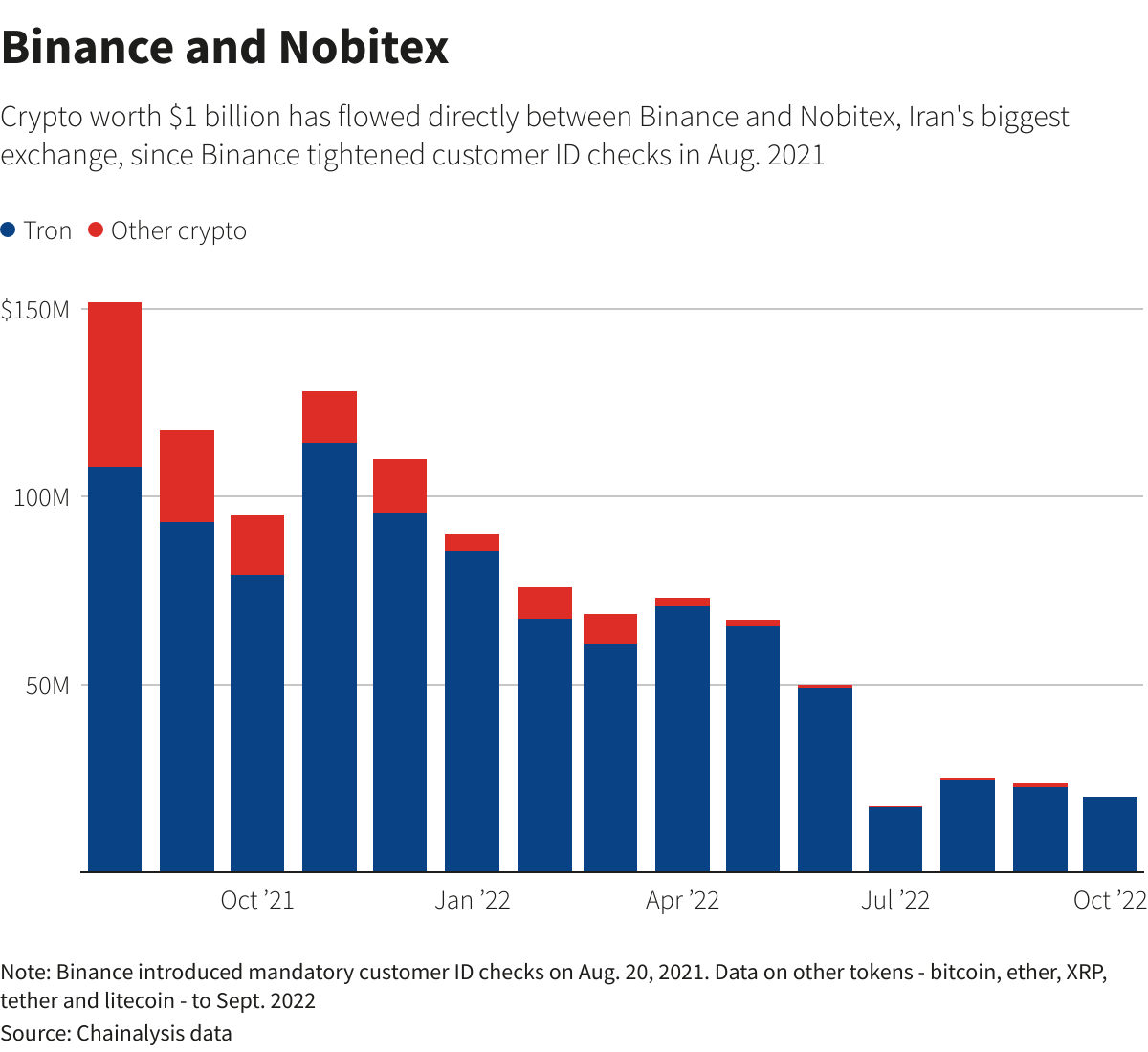

In August 2021, Binance announced that customers will no longer be able to open accounts and use its services without identification. But since then, the exchange has processed almost $1.05 billion of trades directly from Nobitex and other Iranian exchanges, according to Chainalysis data that lasted until November of this year. Since Zhao’s tweet in July, Binance has processed about $80 million in Iranian transactions.

The Binance spokesperson also said in a statement that the company requires a full Know Your Customer verification for all users, and residents of Iran are prohibited from opening or maintaining an account:

“We are constantly updating processes and technology as we learn about new risks and potential risks. As a result of these efforts, including real-time transaction monitoring in coordination with external vendors, between June 2021 and November 2022, Binance’s influence on Iran-related entities has drastically decreased.”

Data verified by Reuters shows that a total of about $2.95 billion of crypto has been moved between Iranian exchanges and Binance since 2018. Also, another $5 billion of cryptocurrencies moved between Iranian exchanges and Binance through intermediaries. Regulators say such “indirect” flows could be indicative of money laundering and sanctions evasion.

Nobitex, in turn, advises its 4 million customers on its website to avoid “direct transfer” of cryptocurrencies between Iranian and foreign crypto platforms for “security”.

Tron

In addition to the Tron token, the rest of Iranian transactions were made in major cryptocurrencies: bitcoin, ether, tether and XRP, as well as the smaller litecoin token.

According to industry data, Binance is the largest market for Tron trading. Some other major exchanges, including US-regulated Coinbase and Gemini, do not list this token. Until recently, Tron has hardly come under the radar of cryptocurrency trackers. Market leader Chainalysis, used by US government agencies, only began fully supporting its tracking in May.

The Tron dataset details over 1.15 million direct transfers between Binance and Nobitex since April 2020, when the first Tron flows were reported. The data contains wallet addresses and a unique identification number for each transaction.

Reuters received Tron figures, as well as additional datasets covering other crypto tokens, from three firms with access to Chainalysis’ Reactor research software. A fourth firm also validated some data on direct transfers based on a separate dataset collected using other software.

Here is the data obtained by Reuters on direct transactions since August 20, 2021, worth about $1 billion.

The total volume of Iranian transactions going through Binance is much larger than through any other exchange. After Binance, the next most popular exchange for Nobitex users since 2018 has been Seychelles-based KuCoin, which has processed $820 million in direct and indirect transactions.

KuCoin and six other Iranian exchanges in the dataset – CoinNik Market, Iranicard, Rabex, Wallex, Sarmayex and Tether Land – did not respond to requests for comment.

Sanction risks

Binance has risen sharply since its launch in 2017. Last month, the company expanded its cryptocurrency reach by investing $500 million in a Twitter buyout by Elon Musk.

The focus of the US Department of Justice investigation is whether Binance violated US anti-money laundering laws. As part of an ongoing case since 2018, the department is also investigating Binance for possible sanctions violations against Iran, three people with knowledge of the investigation said. At the end of 2020, the department asked Binance for records of its compliance program, including any documents related to the transfer of cryptocurrencies for people or organizations in countries including Iran.

In 2018, the US government renewed sanctions against Iran, suspended three years earlier as part of Iran’s nuclear deal with world powers. Since 1979, the West and the UN have imposed sanctions against Tehran for its nuclear program, as well as for possible human rights violations and support for terrorism.

Six lawyers and sanctions experts said the Iranian transactions documented by Reuters put Binance at risk of “secondary” US sanctions aimed at preventing non-US firms from doing business with the sanctions or helping Iranians avoid a US trade embargo. Secondary sanctions could cut off the company’s access to the US financial system.

Binance could also be subject to direct “primary” sanctions if the company has what the U.S. Treasury Department calls “links to the United States,” lawyers and experts said. According to them, such references could include any legal entity registered in the US or transactions processed through the US financial system or using the dollar.

In 2019, British Standard Chartered agreed to pay nearly $930 million to US authorities for sanctions violations, which included moving approximately $240 million through US financial institutions for Iranian clients. French bank BNP Paribas agreed in 2014 to plead guilty to violating U.S. sanctions against countries including Iran and pay $8.9 billion. Both banks have pledged to improve their controls.

Binance says it does not accept clients in the United States. And US customers are directed to a separate exchange called Binance.US, which is operated by a US company registered with the Treasury Department as a money services business since 2019.

Binance CEO Zhao called Binance.US a “completely independent entity.” In October, Reuters reported that he effectively controlled the US stock exchange and ran it from abroad. A Binance advisor in a 2018 address to executives described the US facility as a “de facto subsidiary.”

Most of the $8 billion Iranian crypto transactions identified by Reuters involved the main exchange, Binance. But Binance.US also processed $1.5 million worth of cryptocurrency transactions from Iranian exchanges Nobitex, Wallex and Tether Land, according to Chainalysis data.

U.S. entities that violate sanctions against Iran could face criminal fines of up to $1 million per violation. The defendants face up to 20 years in prison. In October of this year, the Treasury Department fined Seattle-based crypto exchange Bittrex $24 million for violating sanctions on Iran and other countries by processing more than $260 million worth of cryptocurrency transactions. Bittrex said at the time that they were “glad to have fully resolved” this issue.

A spokesperson for Binance.US said that Reuters’ figures for their transactions with Iranian exchanges are not accurate, and that the inclusion of direct and indirect transaction data from Chainalysis “inflates their volume.” The spokesman did not name an alternative figure.

Nobitex

Nobitex, the largest Iranian exchange, was launched in 2017. Its co-founder and CEO, Amirhossein Rad, has a PhD in philosophy and chemical engineering from Iran’s Sharif University of Technology, according to his LinkedIn profile.

The goal of Nobitex, stated on a LinkedIn page earlier this year, is to allow Iranians to invest in crypto despite the “shadow of sanctions.” As the sanctions hit Iran’s ability to do business with the outside world, cryptocurrencies have become popular there for cross-border trading. The exchange said it serves as a “safe bridge between 3.5 million Iranians and the world of cryptocurrencies.”

In its 2021 report, Nobitex stated that it processes 70% of Iranian cryptocurrency transactions. The exchange has encouraged its clients to use Binance in several posts on its website and social media starting this year.

According to Chainalysis, Nobitex users started moving bitcoins through Binance in April 2018.

In a trading guide on the Nobitex website, first published in 2019 and updated in October this year, the company advised users to open accounts to convert their Iranian rials into cryptocurrencies and then transfer to foreign currencies and called Binance “the most reliable.” The following posts in 2020 stated that “for us Iranians, Binance is still the best option” and that Binance “creates less hassle for Iranian users.”

Noting the risk associated with US sanctions, Nobitex’s public terms of use advise clients to avoid “direct transfer” of cryptocurrency from Nobitex to Binance and create multiple digital wallets to move funds in separate stages.

According to Chainalysis, the volume of Tron transactions between Nobitex and Binance has grown since August 2020. That same month, the founder of Tron tweeted that the digital coin had enabled a new feature that allowed traders to mask their faces. This feature, known as zk-SNARK, will provide “user data with the strongest privacy protection in the industry.”

Nobitex customers have been able to use Binance to trade Tron and other crypto tokens since Binance stepped up customer verification on August 20, 2021. The crypto giant processed over $1 billion in direct transactions from Nobitex from this date until November of this year. In October of this year, $20 million in Tron was transferred directly between Binance and Nobitex.

Iranians sanctioned by the US Treasury for cyber attacks and ransomware used Nobitex, according to a September report by Chainalysis. Between 2015 and 2022, more than $230,000 in bitcoin ransomware went into sanctioned Iranian digital wallets, with most of the cryptocurrency sent to Nobitex, according to Chainalysis.

The same month, the Treasury Department said all sanctioned Iranians were linked to the Islamic Revolutionary Guard Corps, a powerful faction that controls Iran’s business empire and elite military and intelligence forces. Iranian authorities did not respond to a request for comment. Iran’s Foreign Ministry called the US sanctions “one-sided, illegal and brutal.”

Source: Reuters