We are publishing a translation of an article by Christopher Beam for Bloomberg from the translation agency Profpereklad , where the author tells the story of an 18-year-old mathematician prodigy. He took advantage of a weakness in the Indexed Finance code and uncovered a legal paradox that is still shaking the entire blockchain community. And then he disappeared.

Top photo: Lawrence Day – Joanne Coates for Bloomberg Businessweek

October 14 Lawrence Day was sitting at his home in England. He was getting ready for a dinner of fish and chips when the phone buzzed. Got a message from a colleague who worked with Lawrence on Indexed Finance . It is a cryptocurrency platform that creates tokens that represent baskets of other tokens – like an index fund, only on the blockchain . A colleague sent a screenshot of a recent trade followed by a question mark.

“If you don’t know where to look, you might think, oh, that’s a good deal,” Day explains.

But he knew enough to be alarmed. Some user bought specific tokens at a drastically reduced price, which in theory was absolutely impossible. Something went wrong.

Day jumped off the couch, scattering food on the floor, and rushed into the bedroom to call Indexed co-founder Dillon Kellar. Kellar was sitting in his mother’s living room at the time, six time zones away from Day, dismantling a DVD player, picking out a laser. He answered the call and heard Day out of breath with the message that the platform was under attack.

“I just said, “What?!”,” Kellar recalls.

They pulled out their laptops and dug into the platform’s code, helped by a few acquaintances and Day’s cat, Finney (named after Bitcoin pioneer Harold Finney), who perched on his owner’s shoulder in support.

Indexed was built on the Ethereum blockchain , a public ledger where transaction data was stored. This meant that there were also records of the attack . The team spent several weeks trying to determine exactly what happened. It seems that the platform was hacked and made so that users’ tokens depreciated sharply, after which they were sold to the hacker at a huge discount. The person responsible for this attack obtained assets worth $16 million.

Kellar and Day stopped the outflow and patched the code to prevent further attacks, and then they got to work with the public. On the platform’s Discord and Telegram channels, token holders exchanged theories and mutual reproaches. In some cases, the platform team was blamed and compensation was sought. Kellar apologized to users on Twitter and took responsibility for overlooking the “hole” in the code. “I screwed up,” he wrote.

Now it was necessary to find the one who initiated the attack and try to return the money. It is believed that most often such schemes in the crypt are used by internal personnel (“guilty until proven otherwise”).

“By default, they will ask who did this and why the developers are doing this?” Day says.

The morning after the attack, Day suddenly realized that he had not spoken to one particular partner. Some coder under the nickname UmbralUpsilon – anonymity in the crypto community is a common thing. Many weeks before the attack, he wrote to Day and Kellar on Discord and suggested they create a bot that would increase the efficiency of the platform. They agreed and paid him a down payment for the work.

“We hoped that he would regularly participate in the development of the platform,” says Kellar.

Since they talked quite a lot, Day waited for UmbralUpsilon to offer help or at least sympathize after the attack. Instead, there is complete silence. Day looked at the chat logs and found that only half of the messages remained. UmbralUpsilon deleted his posts and changed his nickname.

“When I saw this, I jumped out of bed like I was scalded,” says Day.

He shared his suspicions with the team, and for the next few days everyone scoured the net for the cracker’s digital trail. We discovered that the Ethereum wallet that was used to transfer tokens during the attacks was tied to another wallet that received the winnings from the recent hacker contest. The wallet was owned by a member who sometimes referred to himself as UmbralUpsilon. We raised the registration data – it turned out that the wallet is linked to the profile on GitHub.

The owner of the GitHub profile had an email that began with “amedjedo” and was associated with a public school administration domain in Ontario. Day and colleagues also found a Wikipedia profile of the editor with a similar nickname. The editor once made changes on the page of a popular Canadian intellectual game for high school students – added a name in the “Alumni” column: “Andean Medjedovich, an outstanding mathematician.” Google has done the rest. Medjedovic until recently studied for a master’s degree at the University of Waterloo in Ontario, majoring in mathematics. His resume says that he was interested in cryptocurrencies.

The team breathed a sigh of relief. If cyberhackers can be identified, they often return the stolen funds in exchange for a face-saving reward and good hacker status. Day has already contacted UmbralUpsilon and offered 10% for the safe return of all tokens. He even reservedly praised him (“an excellently played combination”). Didn’t receive an answer. Kellar resorted to another tactic – he began to write to Medjedovich, calling him “Andean”. This time, Medjedovic reacted and openly ridiculed Indexed users on Twitter:

“You had an outtrade. You can’t do anything about it… That’s how crypto works.”

One of the team members wrote to him personally and offered $50,000 for the return of the tokens. Medjedovic responded by sending a link to an Ethereum wallet: “Send money.” Of course, the guys did not fall for this bait. To top it all off, it turned out that the burglar was only 18 years old.

Finally, Kellar sent Medjedovic a final warning and threatened that they would be forced to turn to lawyers and the police.

“I suggest you give up now and don’t ruin your life,” he wrote.

The teenager replied with a smiley face that rolls with laughter, and added: “Well, good luck to you.”

Kellar

Photo: Cindy Elizabeth for Bloomberg Businessweek

When Kellar and company created Indexed, they envisioned the platform as the next step in DeFi (decentralized finance protocols). It is a movement that is based on the blockchain and offers a more automated system for lending, asset trading and portfolio management with a minimum of intermediaries. Some proponents have taken a utilitarian stance on DeFi. They see this system as an improved version of “traditional financial transactions”, where paid intermediaries reign, and decisions are made by people and very slowly. Others have taken a libertarian stance and see DeFi as an escape from the current system, a way to get around the rules and restrictions set by governments or corporations. And there are skeptics for whom all this is just another scam.

Kellar considers himself “very progressive” and subscribes unequivocally to the utilitarian point of view. He is 23, and he had already dropped out of the University of Texas at Dallas when he realized that he was not learning anything new in computer science lectures. He founded Indexed to solve the problem: you want to trade crypto, but you don’t want to mess around with a portfolio every day.

In “traditional” finance, investors who want a broad and balanced portfolio of stocks can buy stocks in index funds and outsource the day-to-day work of buying and selling stocks to an investment manager. Kellar wanted to make a similar scheme on the blockchain, but with an algorithm to drive trades. An index fund manager maintains a portfolio that contains the underlying assets of the index stock. The Indexed algorithm allows you to maintain a pool of base tokens for each index token. Users can send one of the underlying assets to the pool in exchange for an index token, a process called minting. Similarly, it is possible to “burn” an index token by sending it back to the pool in exchange for one or all of the underlying assets. Or, like an exchange-traded fund, users can simply buy or sell index tokens on decentralized exchanges (like Uniswap).

Index funds come in many forms, and each has its own investment strategy. Funds like the S&P500 are weighted by market cap. If the value of one of the assets increases, the proportional value of this asset in the portfolio will also rise accordingly. Others want to maintain a fixed balance of securities. For example, let’s say you want Microsoft stock to make up 20% of your portfolio at all times. If the share price has risen, the manager will sell a portion to keep that 20% valuation.

Kellar and his team modeled Indexed around this type of fund. They used an automated market maker (AMM) to keep the underlying assets in balance, as many DeFi platforms do. Unlike a traditional market maker, AMM will not buy and sell assets itself. Rather, it will help establish the desired balance of assets in the pool by adjusting the pool price of its constituent tokens. Then traders will be motivated to buy from the pool or sell to the pool. When more of a particular token is needed in a pool, the price of that token in the pool will increase. When you need to reduce the volume of the token in the pool, the price will fall. This model assumed a rational interaction of users with the protocol (you buy at a low price, you sell at a high one).

By eliminating human managers, Indexed could waive management fees (for example, the platform’s biggest competitor, Index Coop , charged 0.95% just for owning the most popular index token). Indexed took a commission for burning tokens and swap assets within the pool, but only from a small number of users. It was also possible to cut costs by limiting the interaction between the platform and external entities. For example, when Indexed needed to calculate the total value of assets in a pool, instead of checking token prices on an exchange like Uniswap, it sometimes extrapolated the value and weight of the largest token in the pool (the so-called benchmark token). Thus, the costs of transactions in the Ethereum blockchain are reduced. Kellar saw total passivity as “a natural extension of the way index funds work today.”

However, passivity also posed a risk. If there are any problems with the code, someone can use it directly, since there is no additional protection factor in the form of human intermediaries. Limiting blockchain interactions to reduce costs involved a compromise: when there are fewer steps in a smart contract (a script that executes automatically under specific conditions), there is an opportunity to create a security hole.

The list of hacked crypto platforms is already quite long and growing every week ( Poly Network , Wormhole , Cream Finance , Rari Capital and so on).

“It’s often said in DeFi that there are two types of protocols,” Day explains. “Those who have already hacked and those who will soon hack.”

Kellar was aware of one possible loophole for burglars. This is the Indexed mechanism that was used to introduce the token into the pool. Let’s say reindexing occurs – for example, after one token has overtaken another at a market price, so that it can be deposited in a blue chip fund. At the same time, the primary price of a new token is set in the pool, for this a complex equation is used. One of the variables in such an equation is the value of the reference token. By interfering in some way with the pricing of such a token in the pool, it is theoretically possible to trick the pool into charging a lower price for its other tokens as well.

“I fiddled with it for almost two weeks,” Kellar says. However, it did not find any errors. Neither did the two security experts he paid to review the code. “I decided that this could not be an attack vector,” he admits. However, the Indexed website posted a warning: “We are confident in the security of our contracts … [but] cannot guarantee 100% error-free.”

The platform debuted in December 2020 with two index tokens: CC10, which represented the top 10 Ethereum tokens by market cap, and DEFI5, which represented the top five DeFi tokens. Soon the project had a small but loyal group of subscribers, including Day. He had a PhD in theoretical computer science and a master’s degree in financial engineering (index asset portfolio optimization). Indexed suited his interests and satisfied his relatively low risk appetite. “When it comes to investing in anything other than crypto, I’m pretty boring in that regard,” says Day.

Day and Kellar got along well. They had the same absurd sense of humor. A financial expert with a writer’s flair and a creative coder complemented each other professionally very organically. “I’m more of a humanist, and Dillon is more of a techie,” Day, 33, explains. He quit his job at an oil and gas company and became a full-time employee of Indexed in April 2021.

Interest in crypto skyrocketed that year, so Indexed quickly took off and soon became the second largest Ethereum protocol after Index Coop. The guys increased their ambitions, rolled out all the new index tokens and planned an upgrade that would allow them to earn interest on the assets in the pool.

The owners of the DeFi platform Balancer , whose code was taken as a sample for Indexed, were so impressed that they gave Indexed a grant. This actually provided confidence in his future.

When Indexed launched, Medjedovic, known simply as Andy, had just started working on his master’s degree. Should have finished in a year. He usually did everything quickly. He taught mathematics for the tenth grade back in elementary school, graduated at 14, completed his bachelor’s course at Waterloo in three years. (Waterloo is considered one of the best Canadian schools with a mathematical and computer specialization, Ethereum co-founder Vitalik Buterin also studied here.) By the fall of 2021, Medjedovich completed his master’s degree in random matrix theory and planned to apply for doctoral programs.

“I can’t think of a single student in my day who could have gotten a degree at such a young age,” says David Jao , professor of mathematics at Waterloo.

Despite his academic successes, socially Medjedovic lacked maturity. A former classmate who wished to remain anonymous recalls that the guy was “self-confident, even arrogant” and looked down on anyone who did not reach him intellectually. “He considered everything he did or said to be the ultimate truth,” adds a classmate. Medjodovic was clearly flirting with extremist ideas. People heard him speak out for white supremacy and eugenics. (Medjedovic himself did not respond to a request for comment for the article.)

Nevertheless, Medjedovic managed to make friends through playing chess and through the video game League of Legends. He enjoyed reading fiction, especially science fiction. His social media profile included a quote from Kurt Vonnegut’s Cat’s Cradle about the futility of humanity’s pursuit of knowledge:

“The tiger must hunt, and the bird must fly. A person should sit and wonder: “Why, why, why?” The tiger must sleep, the bird must land. A person must tell himself that he understands everything.

Medjedovic also developed coding skills, regularly participating in Code4rena, or C4, an online hacker competition. This is a competition for developers with a cash prize from companies looking for weaknesses in their security systems. He has won prizes in two C4 events. “He seemed quite friendly and cool,” recalls Adam Avenir, who helped run C4 and interacted with Medjedovic before and after the attack on Indexed. “A young, sincere boy.”

Medjedovic has become interested in DeFi, especially the mechanics of AMM. “When I heard about a new product coming out in DeFi, I jumped right into learning how it works and investing if I had a good idea,” he wrote in an email. (Medjedovic declined to be interviewed by phone, but agreed to answer questions by email.) He estimates that he spent hundreds of hours “playing around with the math behind AMM, experimenting with the profitability of different strategies.” Then he began to create bots that were engaged in arbitrage trading on these platforms. So he gradually earned and helped the pools work more efficiently.

After reading about Indexed on a forum, he reviewed the smart contract and noticed in the code “the ability to distort prices” (the same tool that Kellar feared could allow users to distort the pool’s internal price calculations when new tokens are introduced). He also noticed that it is possible to bypass the limit on the size of some trades within the pool. “At first I couldn’t believe my eyes,” he says. Medjedovich made theoretical calculations several times, “and they worked on paper.” He spent the next month writing a script to hack the platform.

He contacted the Indexed team via Discord under the nickname UmbralUpsilon, asked basic questions about the asset structure and price, suggested writing an arbitrage bot for the platform. “I suspect he was probing the waters, looking to see if I could open up some loophole for him to seep into,” Day says, recalling this correspondence. Kellar and Day argue that the information they shared with him could not have contributed to the attack.

Finally, in mid-October, Medjedovic was ready to roll out the code. Importantly, the two largest pools in Indexed are just “ripe” for reindexing. Only one user was needed to enter a minimum amount of the new token – in both cases it was Sushi, the token corresponding to the SushiSwap DeFi exchange.

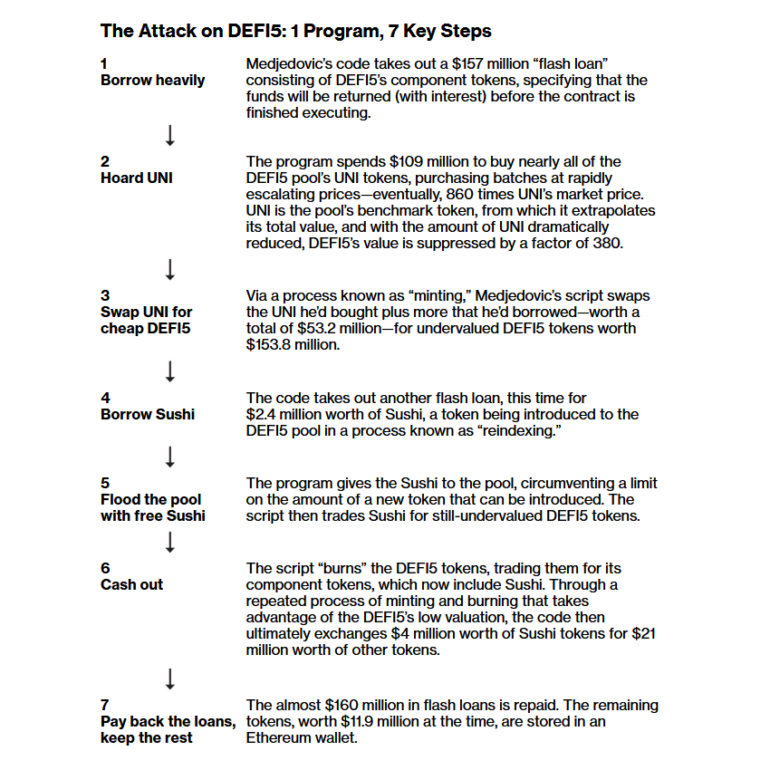

Hundreds of teams were required to crack the “weak spot” – their explanations in court stretched for dozens of pages. But the process itself consisted of only a few key steps. To attack the DEFI5 token pool (and later the CC10 pool), Medjedovic wrote a program that took out a $157 million flash loan. A flash loan, or instant loan, is a mechanism in crypto trading that gives users access to funds until then as long as they are returned in the same set of pre-programmed transactions.

After that, the script used a significant amount of leverage to buy up almost all the UNI tokens in the pool (tokens corresponding to the Uniswap DeFi exchange). The sudden shortage of UNI led to a sharp jump in their value in the pool – the algorithm tried to stop the withdrawal of UNI from the pool and force traders to return them back to restore balance. The more UNI tokens Medjedovic bought, the more expensive they became. As a result, the price exceeded the cost in the foreign market by 860 times. In total, he spent $109 million worth of tokens to buy UNI worth only $5.2 million.

From the outside, such trading seemed crazy, but UNI played a unique role in the DEFI5 pool. It was the very reference token – it was from it that the pool extrapolated its total value. With a sharp decline in the volume of UNI in the pool, the total value, according to the pool itself, was 380 times lower than it actually was. As a result, the number of newly introduced Sushi tokens that would be required for minting DEFI5 tokens has plummeted. Medjedovic could now trade $3.2k worth of Sushi tokens for $1.172 million worth of DEFI5 tokens if he wanted to. And if he did, Indexed would be fine. The protocol sets a limit on the number of new tokens that users can transfer to the pool. Therefore, he would be able to pull out 1.5% of the pool value at the most. Given the commission, this would be generally unprofitable for him.

Instead, Medyedovich’s script took another flash loan from Sushi tokens for $2.4 million. But he didn’t sell it to the pool, but simply donated it – a seemingly irrational step for which the Indexed algorithm was generally not ready and not adapted. Such a “gift” overloaded the pool and bypassed the usual trading limit for new tokens. This allowed Medjodovic to freely trade overpriced Sushi, exchanging it for underpriced DEFI5 tokens, then cash out for the pool’s core assets, repay loans, and keep the $11.9 million balance. up to $16 million

In his letters, Medjedovic recalled being surprised by the success of his exploit. “I only had a couple of test runs to debug it,” he wrote. If the venture had failed, he would have run out of money for the commission for transactions in the blockchain.

“It was really impressive,” says Kellar. “But such talent could have been put to better use.”

If Medjedovic even thought about returning the tokens, then not for long. When the Indexed team identified him, he tweeted a cheeky message:

A single frog hops in the pool, does something cool;

To boil him, they try. ‘Don’t arb that,’ and they start to cry.

But the frog is not dismayed, for he has god on his side.

(One frog jumps into the pool, does something cool.

They are trying to boil it. Arbitrage doesn’t work and they cry.

But the frog is not discouraged because God is on its side.)

In the comments, people were full of admiration for his resourcefulness. Someone posted a crown emoji. Someone else wrote: “I love this guy.”

Some condemned him for racism and tropes: the Ethereum address used for the attack contained the number 1488, which means a neo-Nazi slogan. In the code itself, he entered the word with the letter N ( “Nazi” or “Nazism.” – Note per. ) 16 times. One Twitter user called him Dylan Roof for Balancer Pools (a reference to the mass murderer who shot nine African Americans in a church in Charleston in 2015). Medjedovic liked this tweet.

The weeks that followed were hell for Kellar and Day. They overhauled the protocol, prepared a retaliatory strike, and developed a compensation plan for token holders. As if that wasn’t enough, Finny, Day’s cat, was hit and killed by a car.

On December 9, nearly two months later, Kellar and Day sued Medjodovic in Ontario. According to their statement, his actions were fraudulent and should be forced to return the tokens to the original owners. It turned out that they were not the first in line. An anonymous Delaware company called Cicada 137 LLC had already sued Medjedovic , but the case was frozen. Kellar and Day only found out about him after they filed their lawsuit. According to the lawsuit, Cicada 137 lost the most tokens in the hack, at about $9 million. (Benjamin Bathgate, Cicada 137’s attorney, declined to reveal the identities of his clients.)

By the time Kellar and Day were in court, Cicada 137 had already secured a warrant that froze said tokens. The court could not actually control Medyedovich’s wallets, but if he tried to touch them, he would break the law. Cicada also secured a search warrant at the home of Medjedovic’s parents, where he lived. The search was carried out on December 6, but Medyedovich managed to move out of there, taking all the computer equipment. His parents and younger brother had no idea where he was.

Lawyers for Kellar and Day said two specific stages of the attack violated anti-market manipulation and computer hacking laws. At one stage, almost all UNI tokens were withdrawn from the DEFI5 pool via a swap. Under any other conditions, this is a completely irrational operation. It distorts pricing to the point where Medjedovic was able to buy back tokens from Indexed users who were forced by the algorithm to sell them.

“The sole purpose of such an operation was to mislead the owners and force them to part with the tokens on terms that they would never accept,” explains Stephen Aylward, Kellar and Day’s lawyer. “We argue that this is a form of market manipulation.”

The same argument applies to the Medjedovic operation on the CC10 pool.

The second illegal transaction, according to them, was when Medjedovic overloaded the pool with free Sushi tokens and deceived the algorithm, which allowed him to bypass the limit on the volume of some transactions. Aylward calls it “a deliberate act on Andean’s part to deactivate a security measure, similar to disabling the security system in a bank.” He states that under Canadian law, such activities fall under the “extremely broad” legal definition of hacking. It can be interpreted as “undermining the intended purpose of a computer system”.

Medjedovic has not formally responded to any of the lawsuits. He told me he didn’t even have a lawyer in Ontario. However, in our correspondence, he claimed that he carried out a completely legal series of trade transactions. None of his actions involved “gaining access to a system to which I was denied access. I didn’t steal anyone’s private keys. I interacted with the smart contract according to its own publicly written rules. The people who lost tokens in this transaction are other users who wanted to use the smart contract for their own benefit. They accepted the terms of risky deals, which, obviously, they did not fully understand. ” Medjedovic added that he himself took a “serious risk” when he applied such a strategy. Had it not succeeded, he would have lost “most of his portfolio”. (The 3 ETH he lost on fees was worth about $11,000 at the time.)

This case raises some very serious and complex questions about exactly how people can be allowed to interact with the code on the blockchain. For example, the plaintiffs allege that Medjedovic deliberately “misled everyone” by manipulating the value of the tokens in the pools. But who exactly did it – Medjedovic or the algorithm? Barry Sukman, a Toronto-based IT lawyer, says the difference in definitions makes no difference: “People are responsible for the operation of the technologies they manage.”

If Medjedovich is really involved in fraud, then who was deceived? Andrew Lean is a Dallas-based lawyer who advises Medjedovic but does not formally participate in Canadian courts. He uses this argument to reject the “deliberate misrepresentation” claim.

“It’s not clear who exactly he misled,” Lin explains. – He wrote the code. The code itself is neither true nor false.”

It is impossible to predict the court’s decision without knowing all the facts that may come up during the hearing. So says Andrea Matvishin, a professor of law and engineering at Pennsylvania State University who studies cybersecurity. However, the case is hardly clear cut, especially given Medjedovic’s risk-taking argument. “People on Wall Street often make a lot of money quickly when they see a hole and do strategic research,” says Matvishin. – I can well imagine a world in which the judge weighs various factors, having previously studied the technical and financial specifics of such a scenario. And then comes to the conclusion that there were variables due to which this operation turns into a speculative trading scenario.

DeFi operates in a legal and regulatory gray area that is also unclear. Anyone with technical knowledge can create an investment vehicle, bring it online, and expose users to the risk of an exploit. The head of the US Securities and Exchange Commission, Gary Gensler, said he plans to rule on platforms that trade cryptocurrencies. Dan Berkowitz, former Commodity Futures Trading Commission Commissioner and now SEC General Counsel, called DeFi a “Hobbesian market” with products that violate commodity trading laws. In March, the White House issued an executive order enacting regulations that, among other things, “will reduce the possible risks of digital assets for consumers, investors and businesses.”

The proposed regulations might not have prevented an attack on Indexed, but they would have reduced the risks and helped inform traders about potential threats. So says Ryan Clements , professor of law at the University of Calgary. Perhaps before the launch, mandatory “code verification” by accredited companies, as well as registration under real names, should be established. However, according to Clements, all this will be very difficult to implement. Governments cannot block decentralized platforms the way they can with websites, since they run on global blockchains. And even if they could, imitator platforms will immediately appear.

DeFi purists would rather governments stay away from their platforms. Chris Black, who runs the DeFi Watch website, tweeted that the attack on Indexed was “a disgrace to DeFi” and criticized the platform’s team for going to a centralized institution (i.e. a court) for help. Kellar claims that he sees no alternative – DeFi does not have its own judicial system. In any case, he believes that DeFi should work within the existing legal framework.

“In terms of regulation and project management, this area should remain decentralized,” he says. “But you need a central authority to implement and enforce the ground rules.”

A week after filing the lawsuit, Kellar and Day Medjedovic showed up for a virtual hearing on Zoom. The camera was off and he didn’t say much. The judge ordered him to either transfer the assets to a neutral third party or appear in court in person a week later. When the specified period came up, Medyedovich did not transfer the tokens, and he did not come to court either. The judge issued a warrant for his arrest.

The case hung up until Medyedovich was found or until he himself decided to crawl out of the hole. In a similar non-crypto case, a court could simply order a bank to freeze accounts or surrender assets as soon as the plaintiff receives a default judgment. But due to the nature of crypto wallets, which require a private key to access, the judiciary cannot confiscate these tokens without Medjedovic. I asked him if he spent any of his earnings. He replied, “I don’t spend money.” However, someone recently withdrew almost $400,000 from the wallet used to attack Indexed. The tokens went into a cryptocurrency tumbler, which prevents them from being tracked in the future. Probably Medjedovic is still doing something with the money.

Almost everyone I’ve talked to wants him to stop hiding. Maybe not so much so that they get their money back, but so the court can deal with the tricky legal issues of this case. According to Bathgate, a lawyer for Cicada 137, there is reason to believe that Medjedovic has left the country. Law enforcement in Ontario is not actively looking for him. The Royal Canadian Mounted Police and the FBI declined to comment on the case. By hiding, he will not solve legal problems, they will not just disappear.

“I can assure Andean Medjedovic that litigation is not wine that only gets better with age,” wrote Judge Frederick Myers, who is leading the case.

Medjedovic does not seem to be interested in the sympathy of the public. And that’s putting it mildly. In his letters to me, he alternated between direct answers and obvious trolling. When I asked if anyone was giving him advice, he replied, “I’m texting my mentor Peter Thiel while this whole thing is going on. … It was he who advised me! (A spokesman for Thiel declined to comment.) Other replies included references to “ancestral simulations,” families with “diamonds stored in space,” and a UN program “to break into people’s homes through chimneys to leave the writings of Thucydides under their pillows.” The question of whether he really writes all this seriously, against the background of publications on the Internet, looks almost original.

When asked about the future, Medjedovic reacts rather flippantly: “I don’t worry about where to find a job. Plowing on someone else’s uncle does not smile at me. He does not exclude the possibility of creating his own products. “If the idea of a necessary and useful technology pops into my head, of course, I will create it. So far, I haven’t had any divine revelations in this area.”

Meanwhile, the Indexed team is moving on. They launched an index token in January, but the overall value of the platform has since dropped even further amid a general collapse across the DeFi space, so the planned upgrade is still waiting in the wings. “None of us have that burning desire to work on a project after everything that’s happened,” Kellar explains. Day adds, “Most people agree that Indexed won’t be able to fully deploy anymore.”

On the plus side: Day has a new cat, Katniss. Despite all the damage and harsh consequences, the attack on the platform and the proceedings attracted attention to the guys. Kellar and Day are getting tons of DeFi job offers. Day is also going to law school.

“Very few people can close this gap between technical and legal issues,” he says. “I decided I had to do it myself.”

Medjedovic is still in hiding. In February, Kellar and Day flew to the ETHDenver convention, visited parties and discussion panels, and met with colleagues. But most of the time they talked to each other. It was their first meeting in real life and they had a lot to discuss. Day took a selfie as a keepsake. In the photo, he is smiling, while Kellar looks puzzled. The selfie was posted on Twitter with the caption “Geek squad on the road.”