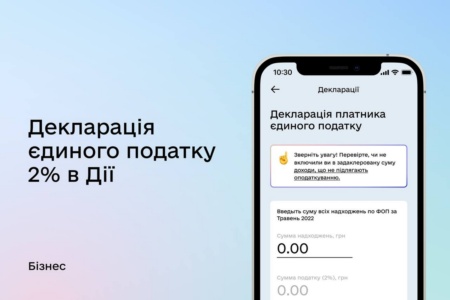

In the application of public services “Diya”, it is now possible to submit a declaration of a 2% single tax payer and pay it. The developers announced this on the official Telegram channel, and the Minister of Digital Transformation Mikhail Fedorov published a video with instructions.

The new service, which is already available in the application, allows you to submit a 2% single tax payer declaration and pay the tax amount to be transferred to the budget in a few clicks. Its payers may be individual entrepreneurs of the 3rd group who have submitted an application to the State Tax Service for the application of a special rate of 2%.

The process is automated as much as possible – the user needs to specify the amount of income in the appropriate column in the Diya application, and the tax amount is calculated automatically. Filling out and submitting the declaration will take no more than 1 minute, assures the Minister of Digital Transformation of Ukraine Mykhailo Fedorov.

How to file a 2% single tax payer declaration in Diya

- In the application, select the menu Services / Taxes sole proprietorship / Declaration of a single tax payer 2%

- Confirm the period for which you want to pay and enter the amount of receipts

- Fill in the contact details and check the application

- Sign the document with the electronic signature “Diya.Signature” and click Submit.

After that, the declaration is submitted to the tax service, and all reporting remains available on the smartphone.

Video instruction

During martial law, the state introduced a special taxation regime of 2% instead of the usual 5%. The system is available to individual entrepreneurs of the 3rd group who have submitted an application to the State Tax Service for a special rate of 2%. These are entrepreneurs who are engaged in various activities: the provision of information services, production, transportation, etc. Individual entrepreneurs who have switched to a 2% rate must submit a declaration before the 20th day of each month for the previous one.